Method Used To Value Closing Inventory

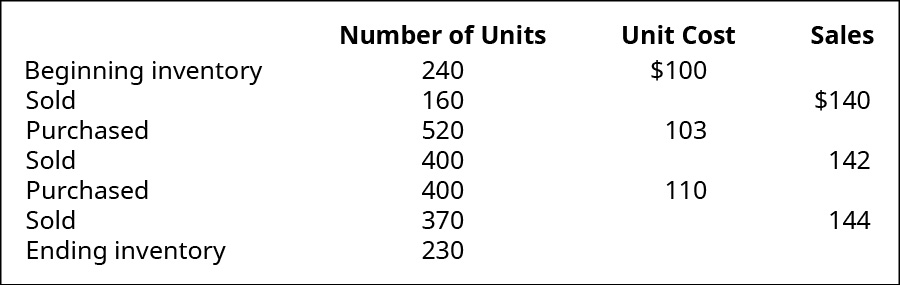

Method Used To Value Closing Inventory. Closing inventory, also referred to as ending inventory, refers to the amount of inventory a business has left on the shelves and in stock at the end of the accounting year. This method assumes that the goods that arrive first are the first to be used.

When a firm does not have to identify specific costs to the revenue this method can be used.

The LIFO method for valuing inventory.

The method used to determine the value of ending inventory will impact financial results, so be sure to choose a method that's right for your business and stay consistent with it. The accountants who handle the cost accounting information add value by providing good information to managers who are making decisions. The cost method you use to value your goods (standard, fifo, avco).

0 Response to "Method Used To Value Closing Inventory"

Posting Komentar